4 Key changes under 2020 Tax Reform

1. Standard Deduction Increases

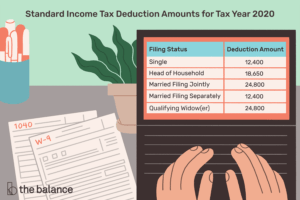

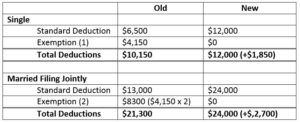

No matter your filing status, the standard deduction increases 2020.

- Single and Married Filing Separately: $12,000

- Married Filing Jointly: $24,000

- Head of Household: $18,000

2. Personal Exemption Eliminated

2. Personal Exemption Eliminated

Under the tax reform, taxpayers can no longer claim the $4,050 personal exemption for each of their dependents.

3. Child Tax Credit Rises

The Child Tax Credit increases in value from $1,000 to $2,000. The tax reform bill also introduces a new $500 credit for non-child dependents.

4. Mortgage Interest Deduction Drops

Individuals who purchase a home in 2020 can only deduct interest up to $750,000 in mortgage debt (previously $1 million). The interest deduction on home-equity loans is eliminated.